Create ichimoku cloud strategies using the indicator condition 'long / short while c1 > c2'. Complex strategies can be formulated as combined 'c1 > c2 & c3 > c4' (both conditions must be satisfied) or asymmetric 'c1 > c2 x c3 > c4' (where 'c1 > c2' denotes the entry and 'c3 > c4' the exit indicator).

Usage

strat(

x,

c1 = c("close", "chikou", "open", "high", "low", "tenkan", "kijun", "senkouA",

"senkouB", "cloudT", "cloudB"),

c2 = c("tenkan", "kijun", "senkouA", "senkouB", "cloudT", "cloudB", "chikou", "close",

"open", "high", "low"),

c3 = c("close", "chikou", "open", "high", "low", "tenkan", "kijun", "senkouA",

"senkouB", "cloudT", "cloudB"),

c4 = c("tenkan", "kijun", "senkouA", "senkouB", "cloudT", "cloudB", "chikou", "close",

"open", "high", "low"),

dir = c("long", "short"),

type = 2

)Arguments

- x

an ichimoku object.

- c1

[default 'close'] column name specified as a string.

- c2

[default 'tenkan'] column name specified as a string.

- c3

(optional) column name specified as a string.

- c4

(optional) column name specified as a string.

- dir

[default 'long'] trade direction, either ‘long’ or ‘short’.

- type

[default 2] if ‘c3’ and ‘c4’ are specified, type 2 will create the combined strategy ‘c1 > c2 & c3 > c4’ whilst type 3 will create the asymmetric strategy ‘c1 > c2 x c3 > c4’.

Details

The following assumption applies to all strategies: confirmation of whether a condition is satisfied is received at the ‘close’ of a particular period, and a transaction is initiated at the immediately following ‘open’. All transactions occur at the ‘open’.

By default, the periods in which the strategy results in a position is

shaded on the ichimoku cloud chart and the strategy is printed as the

chart message (if not otherwise specified). To turn off this behaviour,

pass the strat = FALSE argument to plot() or iplot().

Ichimoku Object Specification for Strategies

The ichimoku object is augmented with the following additional elements:

Columns [numeric]:

$cond: a boolean vector if the indicator condition is met$posn: a boolean vector indicating if a position is held$txn: a vector representing the transactions to implement the position (1 = enter position, -1 = exit position)$logret: a vector of log returns$slogret: a vector of log returns for the strategy$ret: a vector of discrete returns$sret: a vector of of discrete returns for the strategy

Attributes:

$strat: the strategy summary [matrix]

The strategy summary may be accessed by the summary() method for

ichimoku objects or via look.

Complex Strategies

For complex strategies: 's1' denotes the strategy 'c1 > c2' and 's2' denotes the strategy 'c3 > c4'.

Combined strategy 's1 & s2': indicator conditions in 's1' and 's2' have to be met simulateneously for a position to be taken. The column

$condwill show when both conditions are metAsymmetric strategy 's1 x s2': indicator condition in 's1' has to be met to enter a position, and indicator condition in 's2' to exit a position. These rules are applied recursively over the length of the data. The column

$condwill show when the indicator condition is met in 's1'

Further Details

Please refer to the strategies vignette by calling:

vignette("strategies", package = "ichimoku")

Examples

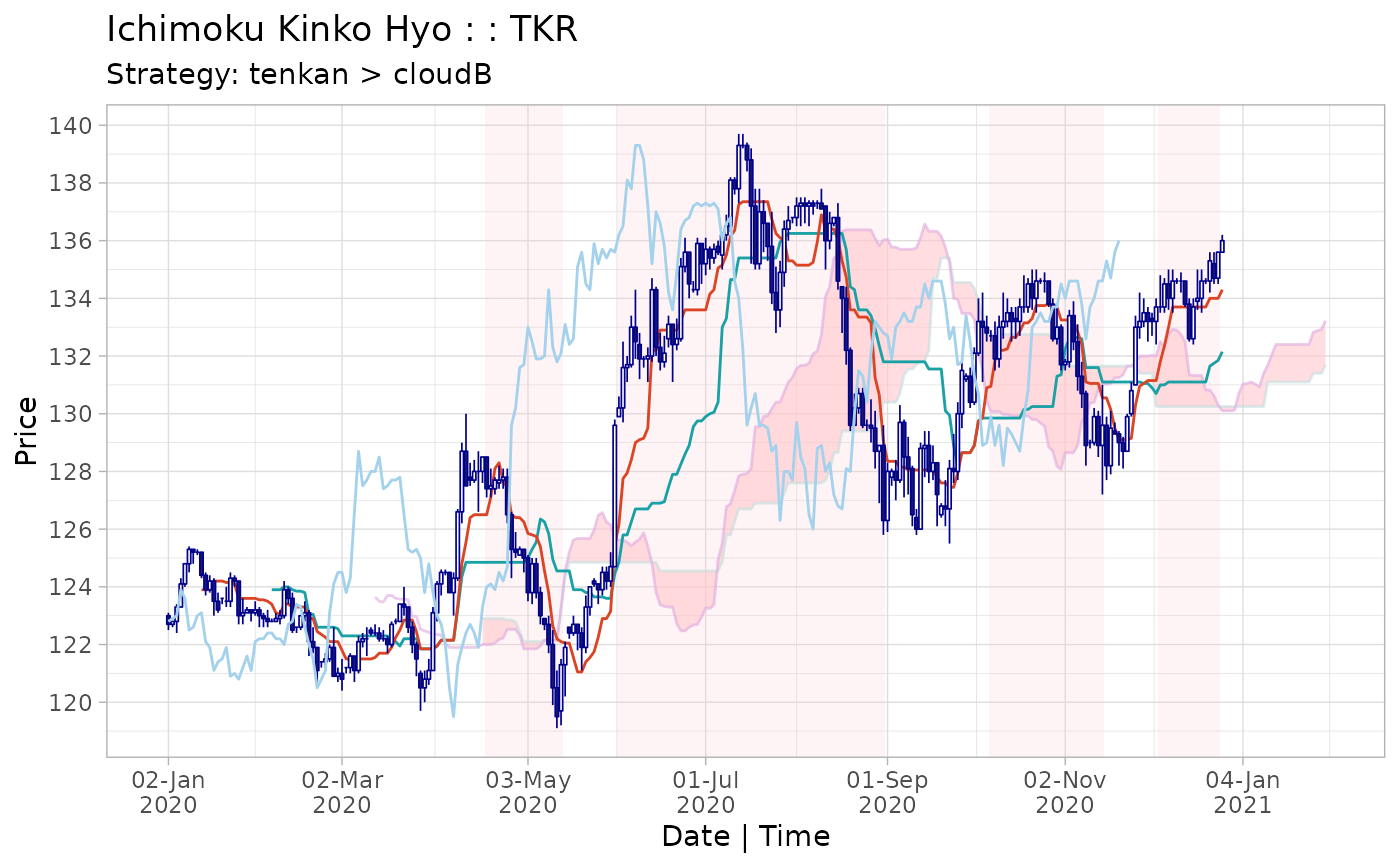

cloud <- ichimoku(sample_ohlc_data, ticker = "TKR")

strat <- strat(cloud, c1 = "tenkan", c2 = "cloudB", dir = "short")

summary(strat)

#> [,1]

#> Strategy "tenkan > cloudB"

#> --------------------- "----------"

#> Strategy cuml return % 10

#> Per period mean ret % 0.0536

#> Periods in market 127

#> Total trades 4

#> Average trade length 31.75

#> Trade success % 75

#> Worst trade ret % -1.42

#> --------------------- "----------"

#> Benchmark cuml ret % -5.24

#> Per period mean ret % -0.0302

#> Periods in market 178

#> --------------------- "----------"

#> Direction "short"

#> Start 2020-04-19 23:00:00

#> End 2020-12-23

#> Ticker "TKR"

plot(strat)

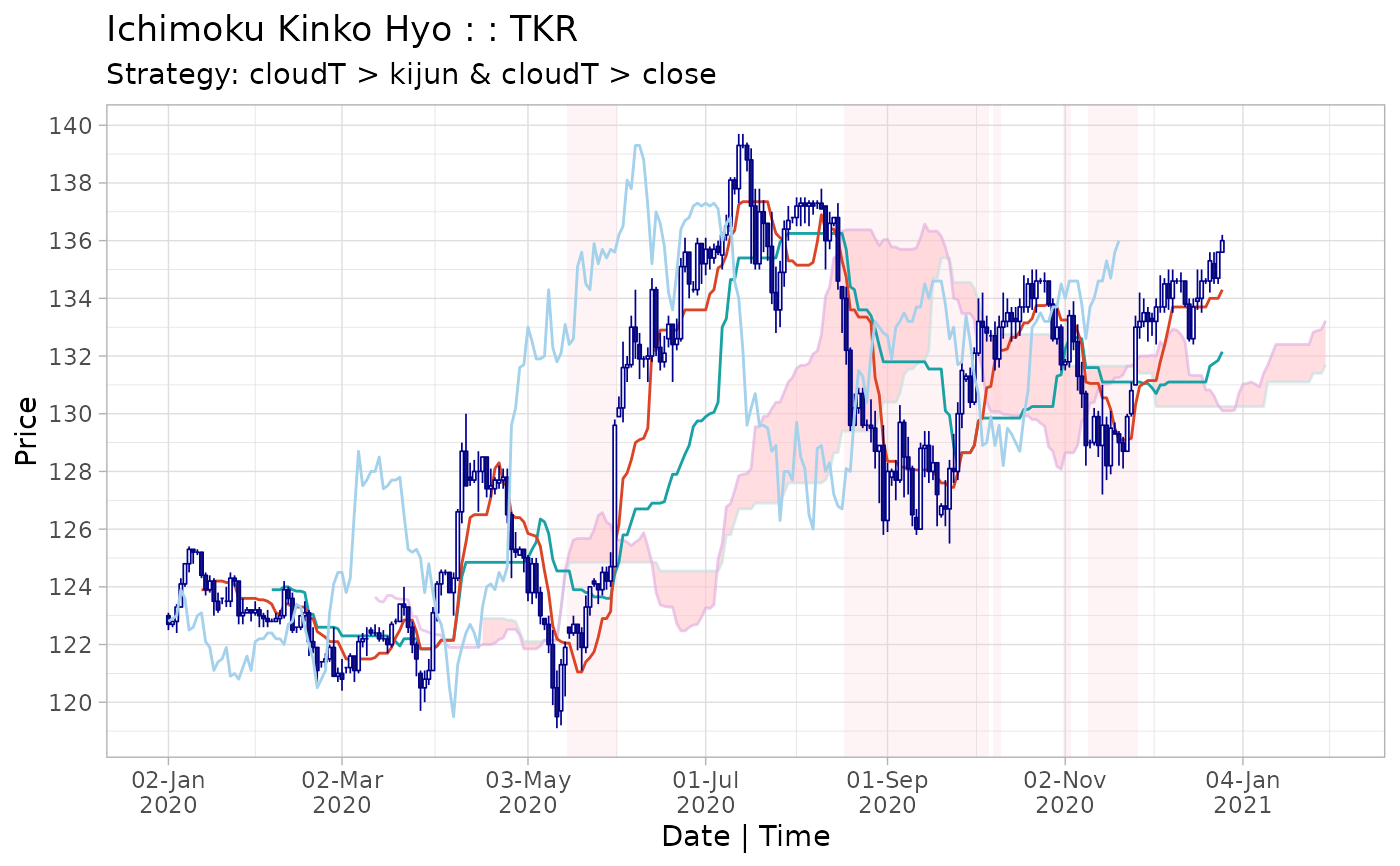

strat2 <- strat(cloud, c1 = "cloudT", c2 = "kijun", c3 = "cloudT", c4 = "close")

summary(strat2)

#> [,1]

#> Strategy "cloudT > kijun & cloudT > close"

#> --------------------- "----------"

#> Strategy cuml return % 9.82

#> Per period mean ret % 0.0527

#> Periods in market 63

#> Total trades 5

#> Average trade length 12.6

#> Trade success % 80

#> Worst trade ret % -0.97

#> --------------------- "----------"

#> Benchmark cuml ret % 5.53

#> Per period mean ret % 0.0302

#> Periods in market 178

#> --------------------- "----------"

#> Direction "long"

#> Start 2020-04-19 23:00:00

#> End 2020-12-23

#> Ticker "TKR"

plot(strat2)

strat2 <- strat(cloud, c1 = "cloudT", c2 = "kijun", c3 = "cloudT", c4 = "close")

summary(strat2)

#> [,1]

#> Strategy "cloudT > kijun & cloudT > close"

#> --------------------- "----------"

#> Strategy cuml return % 9.82

#> Per period mean ret % 0.0527

#> Periods in market 63

#> Total trades 5

#> Average trade length 12.6

#> Trade success % 80

#> Worst trade ret % -0.97

#> --------------------- "----------"

#> Benchmark cuml ret % 5.53

#> Per period mean ret % 0.0302

#> Periods in market 178

#> --------------------- "----------"

#> Direction "long"

#> Start 2020-04-19 23:00:00

#> End 2020-12-23

#> Ticker "TKR"

plot(strat2)